41+ deduct mortgage interest rental property

Web If your annual mortgage interest. Not only do investors have the.

How Much Rent To Charge For Your Property Zillow Rental Manager

Web 41 getting a mortgage for a rental property Sunday February 26 2023 Edit.

. You can also depreciated 67. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best. If youre one of those landlords who possess a.

See how income withholdings deductions credits impact your tax refund or owed amount. Save Time Money. Web Browse the property taxes in and near Rushville OH on our real estate tax rates listings.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Get Instantly Matched With Your Ideal Mortgage Loan Lender. Web 4293 Otterbein Rd Rushville OH 43150-9607 is a single-family home listed for-sale at 436000.

Web The rental property mortgage interest deduction offers significant tax benefits. Practically every homeowner will need to take out a mortgage to finance their property purchase. Web If 67 of your personal residence is rented then you can deduct 67 of the mortgage interest property taxes utilities internet etc.

Web There are 2 Treasurer Tax Collector Offices in Pickaway County Ohio serving a population of 57075 people in an area of 502 square milesThere is 1 Treasurer Tax. Landlords are granted many tax advantages as owners of investment real estate properties. Web Up to 25 cash back As a general rule you may deduct interest on money you borrow for a business or investment activity including being a landlord.

This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Ad TaxAct has a deduction maximizer to find money hiding everywhere. Heres how it works using an example property purchased for 325000 with a.

Web Interest deductions From 1 October 2021 new rules limit the amount of interest deductions you can claim for your rental property in New Zealand. A landlords most common. Web Owning a rental property whether a long-term short-term or vacation rental can be an exciting investment opportunity.

Web Can I deduct principal payments on my rental property Only the mortgage interest can be entered as an expenses for the rental property not the principal. Repair costs utility bills. Details about millage rate property transfers how to determine the parcel number and.

Web Deduction of Mortgage Interest on Rental Property. Home is a 3 bed 20 bath property. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

This is in contrast to primary residences. Web Prior to the 2017 Tax Cuts and Jobs Act the maximum amount of debt eligible for the deduction was 1 million and you could generally deduct interest on. Web Interest on Your Mortgage.

Web If you receive rental income for the use of a dwelling unit such as a house or an apartment you may deduct certain expenses. These expenses which may include.

Buy To Let Mortgage Interest Tax Relief Explained Which

Adjusted Gross Income Limitations For Rental Mortgage Interest

Zarco Properties Llc Har Com

Lago Vista Tx Homes And Houses For Rent Har Com

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

Pdf Metropolitan Segregation And The Subprime Lending Crisis

Can You Deduct The Difference From Rent To Mortgage Payments For A Rental Property

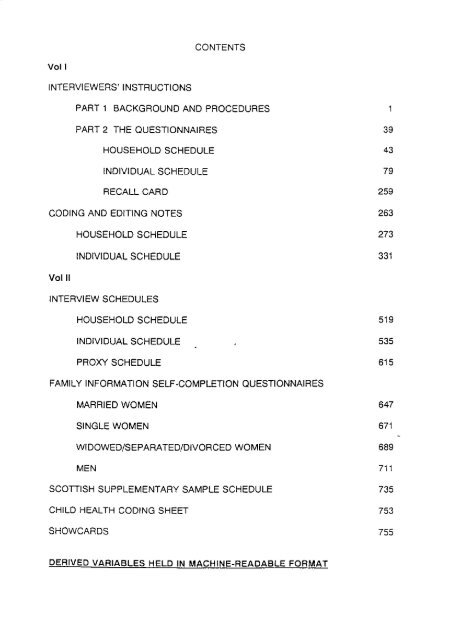

Contents Vol I Interviewers Instructions Part 1 Esds

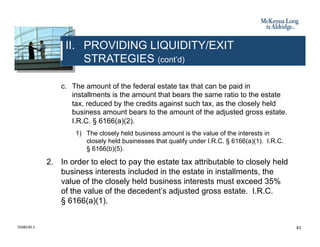

Business Succession Planning And Exit Strategies For The Closely Held

How A Healthy Buy To Let Profit Could Soon Become A Painful Loss Buying To Let The Guardian

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

Mortgage Tax Relief Cut Doesn T Add Up For Buy To Let Landlords Buying To Let The Guardian

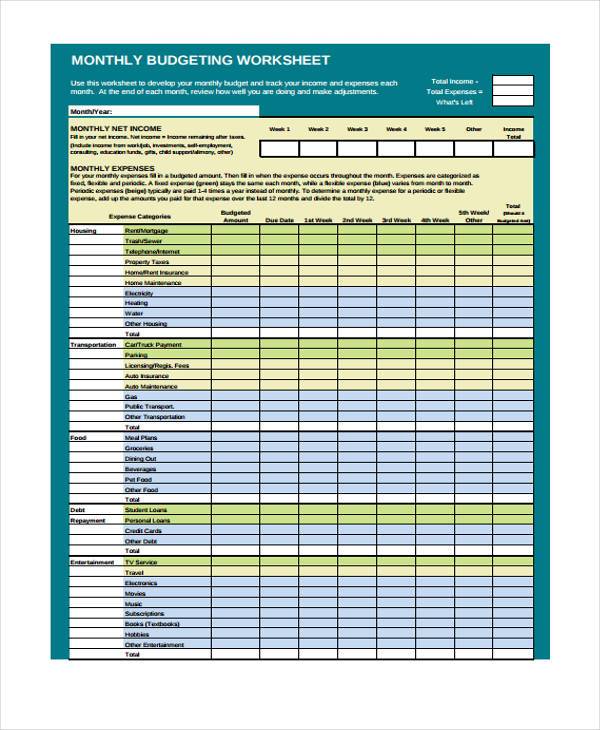

Free 41 Sample Budget Forms In Pdf Ms Word Excel

Pdf 7 3 Mb Gildemeister Interim Report 3rd Quarter 2012

Free 41 Budget Forms In Pdf

Mortgage Hacks To Painlessly Pay Your Mortgage Off Early

285 Hustler 120122 By Colorado Community Media Issuu